Good news! We still have a chance to limit global warming to the desired 1.5°C.

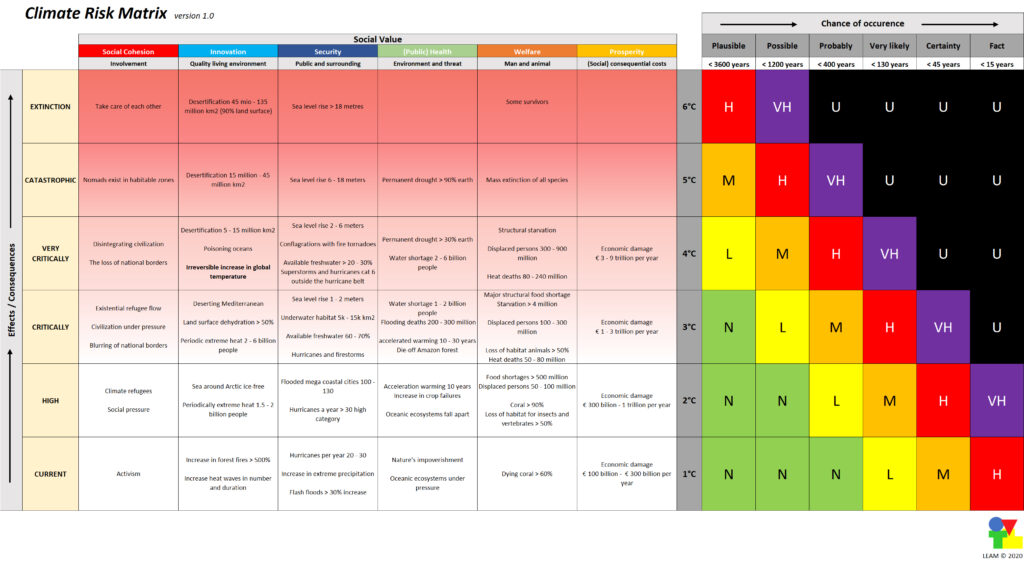

Asset management is about decision making. Making decisions is then supported by a balancing framework. This framework is called the business values model. Often this model is linked to a riskmatrix. The simple approach to risk is opportunity times effect. An unwanted event (effect) multiplies by the likelihood (or variants thereof) of occurrence. With this, asset management decisions find their legitimacy in the risks you want to mitigate. This means that you want to increase the certainty that a risk does NOT occur.

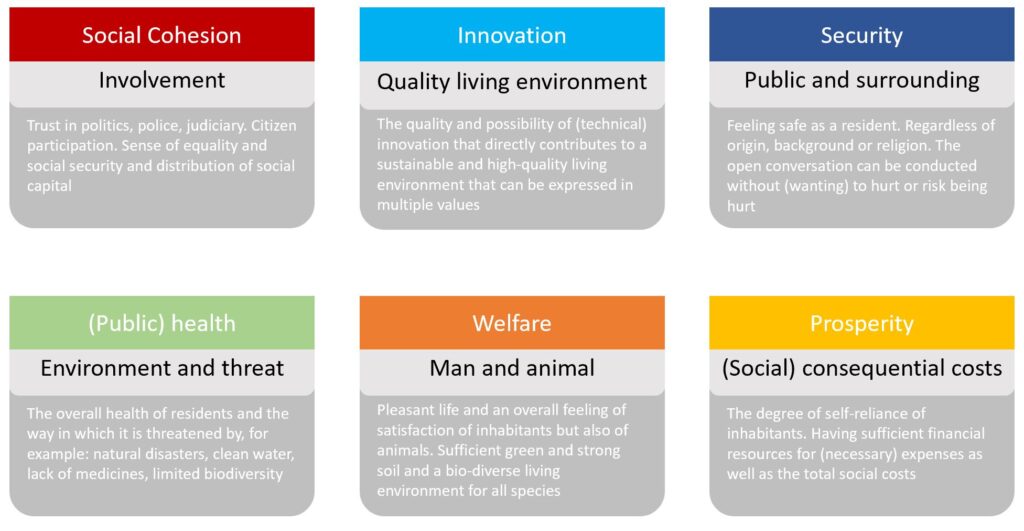

Social value

A better approach to risk is therefore: the effect of uncertainty on the agreed objectives. These objectives are reflected in the company’s values. In the climate riskmatrix, these are social values. The matrix thus provides an imagery of the disruption that the rise of the global temperature causes on social values.

In January 2019, my first climate article on how asset management can contribute to the achievement of climate goals appeared earlier on the LEAM website. This was a mind experiment. For that experiment, it was necessary to develop an equivalent of a set of company values. It became the social values that are also used in the climate riskmatrix.

effect of uncertainty

The degree of the uncertain effect is also important. This can be overcome by an acceptance limit. However, this acceptance limit has a variable bandwidth due to the perception of risk. But the acceptance limit for climate-related risks is not fixed. It is not for nothing that there is no guiding climate policy for the whole world due to the differing perceptions of countries. This is better known as the prospect theory (1979) of Daniel Kahneman and Amos Tversky. The theory states that the preference of decisions in uncertainty depends on the circumstances.

The theory and the accompanying research show that the choice people make by feeling is influenced by the way they are presented. Today we find this important insight for behavioral economics (hidden) back in, among other things, buying behavior on the internet. And thus also in the reports on climate, which unfortunately often give a different picture of reality.

climate riskmatrix

The perception of risk imposes requirements on how we define risk and therefore also how we determine acceptance using an assessment framework or a riskmatrix.

In the context of asset management, risk management is about events that can occur in multiple locations. For example, the thawing of large amounts of ice or forest fires. However, these events do not apply to the climate riskmatrix. They are a consequence of the global temperature getting warmer and even contribute to the effect becoming a cause. This phenomenon is called positive feedback loop. The abstraction of the climate riskmatrix is that it is limited to events that manifest themselves over a longer period, namely the rise of the global temperature itself.

Logarithm

The abstraction forces a scale over a longer period. This can be done by using a logarithmic scale. In the climate riskmatrix, a factor of 3 has repeatedly been applied to both the probability of occurrence and the effect upon occurrence. To utilize the clarity and several other advantages, the matrix is limited to six possibilities on the probability and effect side. Which also corresponds nicely with six degrees increase in temperature. The broader the logarithmic scale is chosen, the greater the uncertainty can / may be to remain in the same risk area. When we set up the matrix properly, each effect category has the same weight for each social value. This allows us to express the risks of each degree of temperature rise in a monetary equivalent. That immediately puts an end to the political discussion how much money to spent on climate. In all cases, the damage is higher than the costs to prevent it. The longer (global) politics remains stagnant or even denying, the greater the consequences we also will experience. You may wonder which circumstance will become THE wake-up call to act decisively as one world.

Exclude perception

Back to the perception of risk. For many people, the word risk has a nasty aftertaste. They prefer to talk about opportunities. It is not about the effect of uncertainty on the agreed objectives, but about opportunities to achieve the objectives. However, risks offer a great opportunity to do better, while opportunities also introduce new risks. For the time being, it is mainly perception that you want to exclude as much as possible with a riskmatrix.

completion of the matrix

In 2007 Mark Lynas wrote his internationally acclaimed work: Six degrees. He described the effects that would occur with a global warming of 1° C, 2° C and so on to 6° C.

On December 12, 2015, The Paris Agreement was presented at the climate conference. It is about the political will to limit global warming to 1.5° C by the end of the 21st century, but certainly not over 2° C. The agreement started on November 4, 2016.

This year, Mark Lynas has written a revised version of his book, the main reason being that the effects he described and envisioned in 2007 for the mid-21st century became reality in 2015. As of 2015, the average temperature of the Earth’s surface has permanently increased by 1° C due to human intervention. And if we continue the same footing, 2° C will be reached in 10 to 15 years. It does not stop there. Due to positive feedback (self-reinforcing effects), under normal circumstances, it is highly likely that everyone in middle age and younger will experience a 3° C rise in temperature in the mid-century and hit 4° C in 50 years from now.

I was deeply touched and shocked, because of which I began to sift through the book and other sources to identify the effects for each social value per degree of warming. To keep the matrix readable, I have identified the main outlines of events. The chosen logarithmic scale of a factor of 3 turned out to be sufficiently consistent to allow for the uncertainties of the future. Uncertainties that seem to be increasingly confirmed by other sources.

Read the matrix

It may take some practice. The bottom row describes current events. Warming is already underway. The oceans, which have absorbed more than 1/3 of the extra CO2 emissions, are already acidifying and disruption of the oceanic ecosystem is in full swing. Life in the oceans is the canary in the coal mine. On the far right we see the chance of occurrence. Translated in the matrix as factual. The intersection where fact (probability) and current (consequence) converge is the current risk. In the matrix this is High (H). The risks run from Negligible (N) to Low (L), Medium (M), High (H), Very High (VH) to Unacceptable (U).

This matrix is a fixed matrix. The effect categories are linked to a degree of temperature increase each time. A category of impact per social value is possible, but this is how you separate them from the increase in temperature.

I wrote that if humanity continues to emit globally as we do now, the temperature will increase by one degree in 10 to 15 years to the maximum 2°C target in the climate agreement. When you read the riskmatrix, the current red risk H is very close to the purple risk VH. A huge set of measures is needed to ensure that the risk will not increase. If we want to reduce the risk, the to take measures will be so far-reaching that they will be disruptive to the way today’s social systems are designed.

the good news

The good news is that we still have the chance to limit global warming to 1.5°C. By immediately stopping CO2 emissions worldwide and completely reducing global livestock to zero in the short term. After which the vacant land is planted with forest and smart arable farming to continue to feed the increasing world population. These measures will certainly introduce many new risks for people and society and how they are systemically organized.

But if we want to survive as humanity, we must face up to the uncertainties that ensue.

This article is a translated version of the Dutch variant that appeared earlier on this website. It is also published at maincontract.nl